NVIDIA’s recent filing with the EU for their proposed purchase of Arm Holdings has set off the beginning of the regulatory review of the deal. The EU has the power to either approve or reject the deal, and the scrutiny that accompanies it is unprecedented.

With the potential implications for the global economy and technology industry, let’s take a look at why NVIDIA’s Arm deal is facing such close scrutiny.

Nvidia’s EU Filing for Arm Deal Kicks Off Tough Scrutiny

Nvidia’s proposed acquisition of Arm Ltd. is facing intense scrutiny from a number of European regulators. The deal is estimated to be worth over $40 billion, making it one of the biggest tech mergers in history. While the two companies hope to close the deal by the end of 2021, antitrust regulators in Europe are signaling that they will take a hard line on any attempt at monopolizing control over Arm’s architecture and semiconductor licensing service.

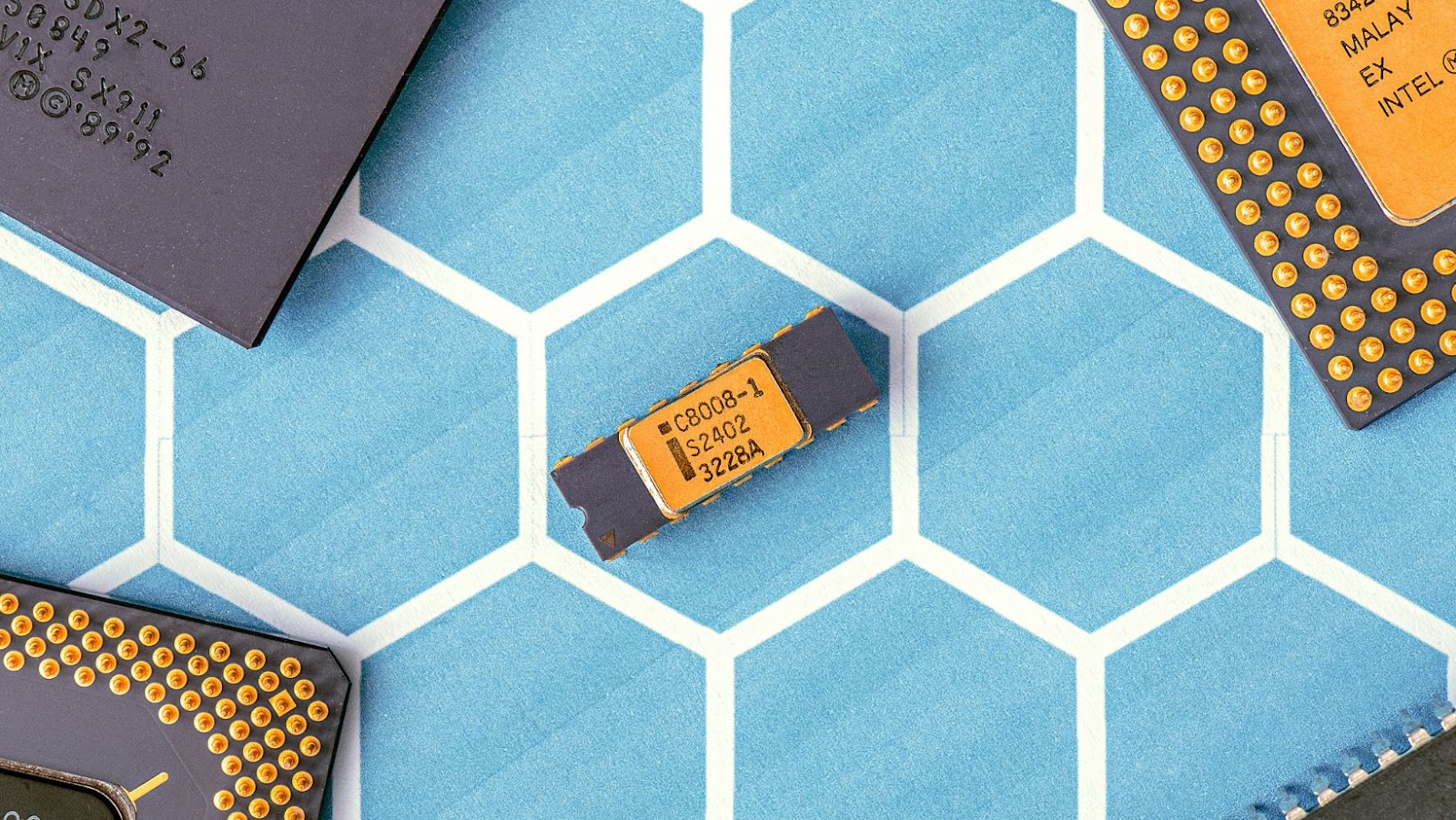

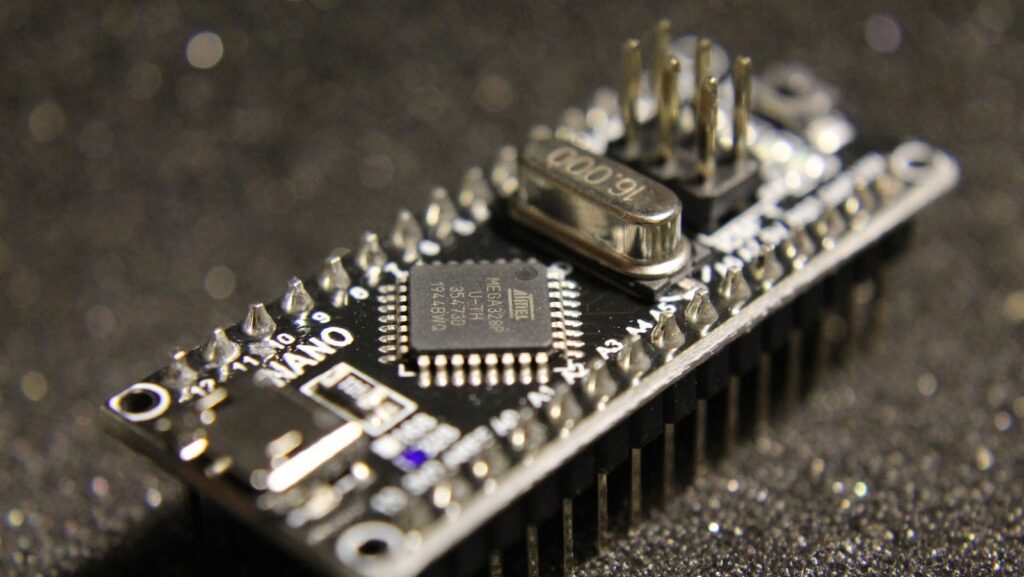

Arm is a UK-based company best known for its architecture and semiconductor technology, which powers much of the world’s mobile phones, smartwatches and other devices. Nvidia has signaled it intends to use Arm’s technology to expand its own GPU business in data centers, automotive applications, machine learning technology and gaming devices.

In October 2020, Nvidia filed notification with the European Commission seeking approval for the acquisition under EU merger rules – kicking off what many anticipate will be an arduous process that puts pressure on both companies to comply with a wide range of requirements set by EU antitrust authorities if they want approval for the deal. These include proving that such a combination would not reduce competition on price or innovation in products and services in current or future markets; demonstrating compliance with foreign ownership laws; securing commitments from competitors; and addressing potential market concentration problems raised by third parties.

Antitrust Concerns

As Nvidia’s filing to European Union antitrust regulators concerning its proposed acquisition of Arm Limited kicks off a period of intense scrutiny, there are increasing concerns that the deal may restrict competition in the chip market. Many of these concerns center on the potential monopoly control Nvidia could gain over Arm’s cutting-edge technology and products.

In this article, we will delve into the antitrust aspects of the deal and assess the implications it could have on the chip market if it goes through.

EU’s investigation of the deal

Nvidia’s $40 billion acquisition of chipmaker Arm is facing close scrutiny by European Union regulators. The investigation centers on the potential anti-competitive effects of the deal, which would combine two major players in the global semiconductor industry.

The European Commission has opened an in-depth investigation into the proposed merger, which was first announced in September 2020. The Commission is trying to determine whether the deal would reduce competition and innovation in two key areas of chipmaking: central processing units (CPUs) and graphic processing units (GPUs).

To analyze the deal, EU officials will look at how it could affect innovation and consumer choice for CPU and GPU products. They will also examine how it would impact competition in markets related to these products such as gaming consoles, mobile phones and cloud servers.

The Commission’s review period is expected to last until January 2021. During this review period, Nvidia must remain independent from Arm while ARM remains open to other companies wishing to license its technology during this period. If the merger passes EU scrutiny, Nvidia will be able to move forward with its announced plans for Arm.

US and China’s scrutiny of the deal

The acquisition of Arm by Nvidia, a US-based company, underlines the growing assertiveness of US and Chinese authorities in scrutinising big tech deals. As part of the $40 billion deal, US and Chinese regulators must assess whether the deal could reduce competition or harm consumer welfare.

In the United States, Nvidia’s filing with the Federal Trade Commission (FTC) includes details of its proposed transaction with Arm to establish an open licensing platform that will keep Arm’s technologies widely available. The FTC will then make a determination on whether or not this move is anti-competitive or monopolistic.

Meanwhile, regulators in China have expressed concerns about the rapid consolidation of tech firms due to digital companies such as Alibaba, Tencent and Baidu investing heavily in digital technology startups. The Chinese government – which requires approval for any foreign acquisition over a certain size – has said that any potential transaction will be carefully examined to ensure it does not hurt market competition. To date, no reports have been released detailing how the Chinese review process is progressing.

Potential Impact of the Deal

Nvidia’s EU filing for the acquisition of Arm Holdings has kicked off a series of tough scrutiny. The deal has been estimated to be around $40 billion USD, and it could have major implications for the semiconductor industry at large.

This article will discuss the potential impact of the deal, both positive and negative, on the market.

Potential monopoly in the tech industry

The tech sector is highly competitive and growth poised to continue due to the rapid expansion of new technology-driven products and services. Therefore, any potential consolidation or monopolization of the sector could be detrimental to the development of innovative products, services, and tools. With this in mind, it is important to consider what long-term effects Nvidia’s acquisition of Arm could have on competition in the tech industry.

Nvidia’s EU filing for its planned acquisition of Arm Holdings kicks off a comprehensive review process that will assess whether or not it would create an unfair monopoly in the chipmaking industry. The European Commission is expected to scrutinize various aspects of the deal; such as how it affects smaller companies in the ecosystem that rely on Arm’s technology or compete with firms owned by Nvidia. Areas being reviewed include: pricing; foreclosure; access; and innovation incentives within the semiconductor industry, particularly for high-performance computing chips used for artificial intelligence and graphics processing applications.

The Commission may also investigate potential barriers posed by a partnership between two huge corporations at opposite ends of a supply chain – from manufacture through to market sale – potentially stifling growth from competition and small businesses trying to enter into this lucrative market. Additionally, antitrust officials from China and Britain have also opened investigations into Nvidia’s proposed purchase. If approved, this groundbreaking acquisition will leave just five manufacturers dominating design for most chips sold worldwide – Intel Corp., AMD Inc., Apple Inc., Qualcomm Technologies Inc., and now potentially Nvidia Corp – creating an unanswered question as it relates to unforeseen economic consequences on innovation or pricing practices within digital technology markets.

Impact on competition

The European Commission (EC) is charged with protecting the interests of consumers by controlling anti-competitive mergers. With its proposed acquisition of Arm Ltd., Nvidia has thrust itself into the global spotlight – with the full scrutiny of the EC set to follow.

The EC will focus not only on whether or not Nvidia actually has an illegal advantage in its acquisition of Arm, but also on how the deal will limit competition in both global and regional markets by potentially creating or strengthening a monopoly. Qualitatively speaking, this would mean less competition from other chip manufacturers and could lead to increased prices for those products.

A core component of the EC’s evaluation is likely to be how this new combination affects innovation by potentially stifling innovation through higher prices charged for GPU devices, more concentrated competitive market forces, and reduced bargaining strength. In order to approve this merger, it must be concluded that it stands to create a single player who can act freely who will also provide better terms to their customers than if constraints existed on their activities due to fear of competitive disadvantage from others in their field.

The Commission has indicated that due diligence investigations can take up to four months’ time before any determination is made about allowing such a consolidation, with an additional two months for appeal; depending on circumstances that timeline could be longer still so Nvidia’s proposed $40 billion dollar Arm deal is still very much at risk pending further scrutiny by regulators over many potential impacts.

tags = Nvidia, EU Filing, Arm Deal, Nvidia Corp. European Union, Qualcomm Inc. and Alphabet Inc, nvidia commission arm eu oct.whitebloomberg, Japan’s SoftBank

More Stories

The Impact of Gamification: Engaging Features in Online Slot Platforms

Experience the Magical Melodies of Wealth with ‘Spectral Symphony’: Harmonies of Slot Riches

Things to Know Before Trying Out Online Casino Gaming