The European Union (EU) Competition authorities are currently investigating an acquisition by U.S. technology company Nvidia of the British chip designer Arm Holdings. The takeover worth $54 billion, a tech-sector record, is subject to antitrust scrutiny in the EU due to worries about its impact on competition and innovation in the semiconductor industry.

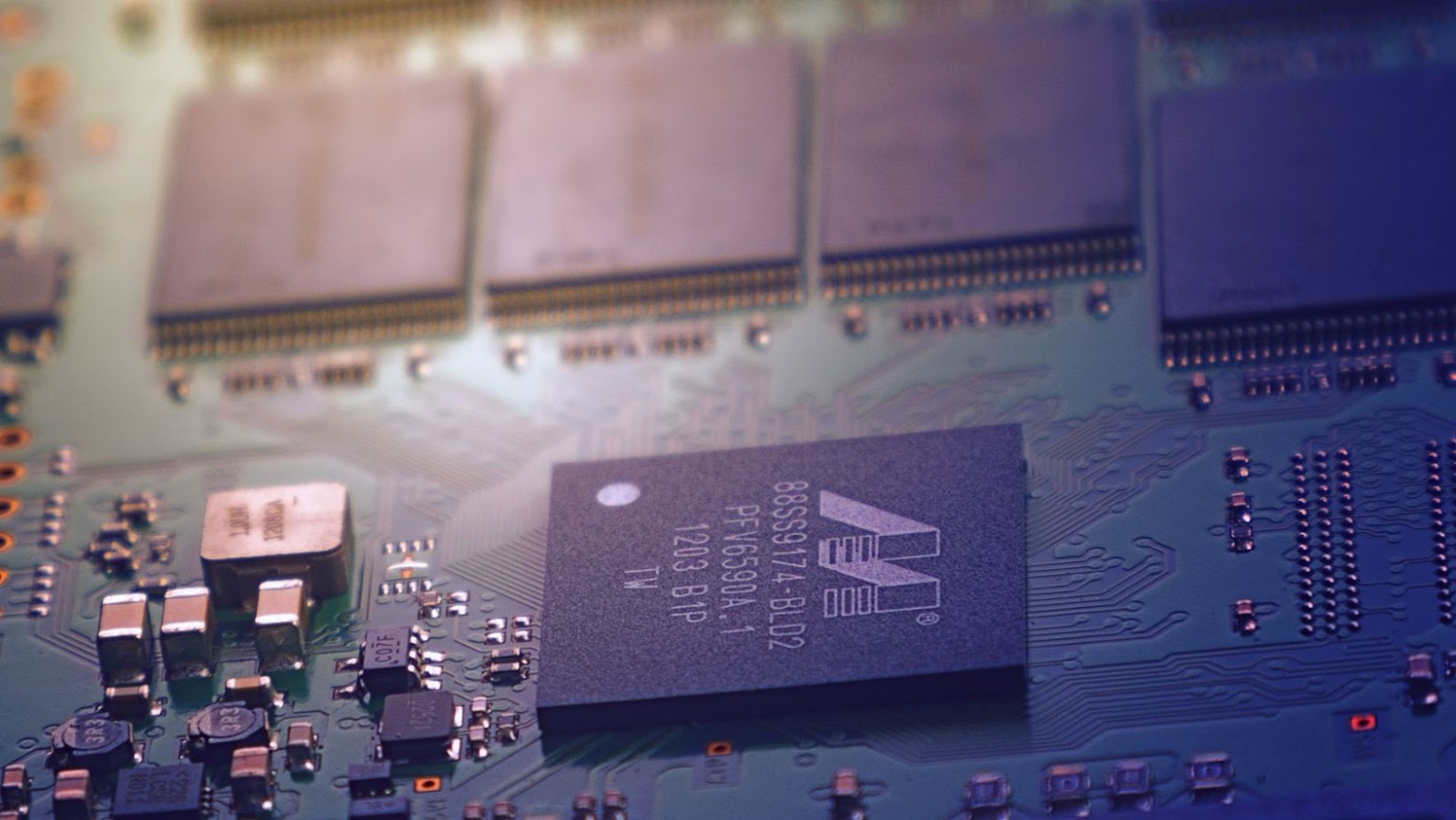

The European Commission (EC) opened an investigation into Nvidia’s proposed acquisition of ARM in December 2020, concerned that the merged entity would control a significant number of important patents necessary for developing semiconductor technology, leading to reduced choice and higher prices for consumers and businesses. This could affect internet-enabled devices such as smartphones, computers, advanced driver assistance systems, autonomous vehicles and home appliances.

The EC recently announced that it is extending its analysis period in light of remedies proposed by Nvidia to address these concerns. While negotiations with the EU competition watchdog reportedly took place over months with both parties engaging external legal counsels, these remedies appeared inadequate to satisfy competition authorities prompting an extension in order to further analyze them – potentially having to further scrutinize both competitors’ business strategies throughout the industry depending on their findings.

EU to investigate Nvidia’s $54 bln ARM bid after remedies fall short – sources

The European Commission has been investigating Nvidia’s bid to acquire ARM from SoftBank since September 2020, to determine whether the takeover could significantly reduce competition in the European Union. The Commission is set to complete its investigation into the proposed takeover on May 20, 2021.

The Commission’s investigation is largely focused on data centers, where Nvidia supplies processors for high-performance computing and graphics processing. It is concerned that Nvidia may use its control of ARM’s technology and intellectual property rights to discriminate against rivals in the market for graphics processors or CPUs used in data centers.

In particular, the EU is looking at whether customers buying PROCESSORS could be given terms by Nvidia that are unfairly better than those offered by vendors of other x86 PROCESSORS or ARM compatible PROCESSORS. The EU is also examining how (and possibly when) ARM will continue to make available licensing options for its three arm licensed processor cores: Cortex-A7, Cortex-A15 and Cortex-A57. The EU wants assurances that ARM will continue to make these cores available at fair prices without preferential treatment being given to customers of products supplied by Nvidia over competitors’ products based on other processor architectures such as Intel or AMD x86 products compatible with ARM architecture.

The investigation will also assess whether any changes proposed by NVIDIA would effectively weaken community collaborative elements and preclude small developers from taking part; diminish offerings for open source software developers or lead edge computer systems; increase barriers to entry for new companies; lessen incentives on investments in research and development; limit access limits to technologies from small companies providing specialised services; or hinder technological innovation within Europe that would negatively impact consumer choice and welfare over time.

Impact of EU Investigation on Nvidia

The EU has launched an in-depth investigation into Nvidia’s $54 billion bid to acquire ARM over fears that such a deal could significantly reduce competition in the chip sector.

There are many implications of the EU’s investigation on Nvidia, ranging from potential divestments to pricing restrictions. In this article, we will explore the potential impact of the EU investigation on Nvidia.

Potential legal and financial implications

Nvidia Corporation’s proposed $54 billion takeover of ARM Holdings, a British semiconductor and software design company, is now under investigation by the European Union (EU) after recent efforts to remedy antitrust concerns failed to satisfy EU regulators. Nvidia’s acquisition has been met with criticism from competitors and consumer groups alike who believe that the deal will create an industry monopoly.

The EU’s investigation into Nvidia’s bid could subject the company to further financial commitments or legal actions if it is found that they are in violation of antitrust laws and competition regulations. If proven guilty, legal consequences such as fines or divestment orders could be imposed on Nvidia as punishment for their anti-competitive behaviour. Furthermore, these penalties have the potential to severely affect the profitability of their proposed takeover, as any penalties paid out would be taken directly from potential profits that would have been gained from the acquisition. In addition, there will also be increased uncertainty on behalf of investors and shareholders due to regulatory risk that can potentially hinder or delay successful completion of the deal.

Investigations from other regulatory authorities such as The UK Competition & Markets Authority (CMA) may also follow if violations are found during the EU investigation. While investigations by such bodies may not result in direct financial sanctions, companies found guilty by such agencies often incur substantial reputational damage that can lead to long-term losses for their businesses through lost market share or consumer distrust.

These potentially severe legal and financial implications could determine whether or not NVIDIA’s ARM bid succeeds or fails in completion. It is likely that tensions between NVIDIA and regulators will continue whilst investigations take place but only time will tell how this affects this major takeover attempt by one of Silicon Valley’s largest corporations.

Potential impact on Nvidia’s stock price

The European Union’s decision to investigate Nvidia’s acquisition of ARM has major implications for the company. This is due to the fact that the European Commission is concerned that the transaction would lead to anti-competitive practices, which could have a negative impact on Nvidia’s stock price.

Nvidia agreed in September 2020 to acquire ARM from SoftBank for $54 billion, making it one of the biggest deals ever in chipmaking. The deal was seen by many as a move by Nvidia to gain an even bigger foothold in the semiconductor industry, and it sent its stock soaring after it was announced.

However, competition regulators at the EU are reportedly concerned about how a merged Nvidia and ARM would affect competition in two main markets; graphics processors and server chips. Although Nvidia proposed some remedies as part of its commitments when it applied for approval of the merger, EU authorities concluded that they were insufficient. As a result, they launched their own investigation into whether or not the acquisition would create an unfair advantage in either market.

While there is still much uncertainty around how this investigation will play out, investors are right to be cautious about how this could affect Nvidia’s stock. If regulators decide that there have been anti-competitive practices within either market due to this merger, investors could experience losses should regulators impose heavy fines on companies who have broken these regulations or block certain aspects of their business operations all together.

Impact of EU Investigation on ARM

The European Union’s antitrust regulator is looking into NVIDIA’s $54 billion bid to acquire ARM Ltd after the company failed to provide adequate remedies to its competitors’ concerns.

This investigation has huge implications for the future of the ARM business and could lead to long-term repercussions for the semiconductor industry.

In this article, we will take a closer look at the impact of the EU’s investigation on ARM.

Potential implications for ARM’s business model

As per recent reports, the European Union (EU) is investigating Nvidia’s $54 billion acquisition of ARM Ltd. The EU has clear questions concerning potential implications around the transaction and has raised doubts about Nvidia’s commitments to license technology at fair rates and preserve innovation competition.

The EU investigation, commonly known as a Phase 2 in-depth probe, reflects regulators’ fears that the merger of ARM and Nvidia would reduce innovation by making the chip designer unavailable for other businesses by offering exclusive licenses for new products. There are also concerns that existing customers could face unfair terms when negotiating license renewals with an enlarged Nvidia-controlled ARM business. Further, disruptions to existing business models hinge on how Nvidia implements strategies such as introducing new and more exclusive license types as well as how it manages customer relationships and pricing.

In conclusion, while this investigation offers certain reminders to companies seeking mergers in similar sectors, it may cause long-term implications if Nvidia pursues its ambitions to expand its data center scale or even modify its royalty and licensing requirements. Such changes may have a profound effect on ARM’s business model potentially resulting in customer dissatisfaction or future lawsuits.

Potential impact on ARM’s stock price

The news of the European Commission’s (EC) investigation into Nvidia’s proposed $54 billion acquisition of ARM has had a significant impact on the stock price of ARM Holdings PLC.

In the days leading up to the announcement, share prices for ARM began to fall as investors reacted to increasing uncertainty around the potential deal. Within 24 hours of the news, shares in ARM had fallen by 4.5%. This continuing downward trend has been attributed to investors increasingly worrying that regulatory concerns could prevent Nvidia from completing its deal.

Since then, regulators have increasingly taken a more critical stance towards digital companies and their proposed mergers—a move which may further add uncertainty to any potential takeover bid by Nvidia. If this bid fails, it could mean a substantial setback in arm’s financial future and the value of its stock price.

It is clear that any news concerning this takeover bid and its progress through EU analysis boards will be closely watched by investors who may consider taking their money elsewhere if there is an extended period of uncertainly or if regulatory concerns ultimately intervene in stopping a potential deal between Nvidia and ARM Holdings.

Impact of EU Investigation on the Tech Industry

The European Union’s (EU) investigation of Nvidia’s plan to purchase ARM Limited for $54 billion has raised eyebrows in the tech industry, especially as the EU’s competition commission has been increasingly active in its investigations of tech companies in recent years.

This investigation has the potential to greatly impact the tech industry and the competition between tech companies. In this article, we will look at the impact of the EU investigation on the tech industry.

Potential implications for the semiconductor industry

The European Union is evaluating whether Nvidia’s proposed $54 billion purchase of ARM Holdings could lead to reduced competition and higher prices for consumers, according to sources familiar with the matter. If the EU’s investigation finds this to be the case, the implications for the semiconductor industry could be long-lasting.

A hostile takeover of ARM Holdings could significantly disrupt supply chains and make it more difficult for customers such as Apple and Qualcomm to get their chips made in the current fabrication infrastructure. Nvidia may also choose to discontinue a number of ARM architecture products, including those that provide access to competing platforms such as Google’s Android. This would hurt rivals who rely on ARM architectures for their own custom chips, silencing innovation and ramping up costs for their customers.

Additionally, these changes could have major implications on NVidia’s role in developing cutting-edge technology across many sectors. Potential worries regard how NVidia would use or access newly acquired data if they had control over ARM’s customer base. For example, legal concerns may erupt regarding protection of users’ personal or confidential information on connected devices that are part of internet of things (IoT).

The EU is working hard to evaluate competing offers from traditional giants such as Intel and Qualcomm, as well as newcomer Advanced Micro Devices (AMD). These companies have contested various buyer proposals-including one from Intel which involves acquiring parts or assets from some semiconductor suppliers – but Intel has stated that structural remedies alone will not be enough to resolve potential issues associated with a hostile takeover by Nvidia. Although it remains difficult to predict what will happen with a successful acquisition by any party, it is clear that any fallout from new market conditions established via this takeover will ripple through much of technology industry, potentially creating lasting social and economic changes in the process.

Potential implications for the tech industry

The European Union’s investigation into Nvidia’s proposed $54 billion acquisition of ARM Holdings could have serious implications for the tech industry. If the EU ultimately rules that the merger would impair competition in Europe, large parts of the industry could be affected.

The outcome of this case could provide a precedent through which similar large tech acquisitions will be judged in the future. This could mean that companies with dominant positions in certain markets may need to consider potential competition issues before they make future mergers and acquisitions.

The potential impact on competition within ARM’s customer base, such as semiconductor and chipmaker companies, could cause further disruption throughout the tech industry if regulators decide that it creates an uncompetitive market for its customers or makes them vulnerable to changes in prices or products over time.

Moreover, if regulators decide that the merger is anticompetitive then its effects will likely extend beyond the specific parties involved – European Union officials have already signaled that they may require structural remedies from Nvidia such as selling off some of its assets or scaling back some operations – these decisions would set a new baseline for competitive behavior in global markets and form a barrier to further consolidation for other firms seeking entry into them.

Ultimately, if this case sets a new precedent then small companies leveraging free and open-source technology might end up becoming vulnerable to anti-competitive behaviour from larger tech conglomerates. If this situation arises, there will be serious implications for innovation throughout the sector it serves, potentially stifling growth beyond what we can imagine now.

tags = EU, Nvidia, $54 bln ARM bid, British chip designer ARM, nvidia european commission eu oct.whitebloomberg, EU investigation, EU antitrust investigation

More Stories

Cosakavaz: Leading Innovation in Smart Home, Wearables & Sustainable Technology

Yularisfibrilz: The Game-Changing Tool Boosting Productivity by 30%

Oticon Domes: Comfort and Clarity for Your Hearing Aids